Technology

COD Payments and Mobile Integration A Practical Guide to Optimizing Small Transactions

Why the Spotlight on Small Transactions?

In an era where frictionless digital payments dominate, there’s one method that still plays a critical role—Cash on Delivery (COD). Especially in regions with lower digital penetration, COD remains essential. But how can we optimize COD processes when small-value transactions are involved? The answer lies in pairing it with mobile integration strategies.

What Is COD and How Does It Work Today?

Cash on Delivery is a payment method where customers pay in cash when goods are delivered to their doorstep. While it sounds simple, managing it effectively—particularly for low-value purchases—is a different story. Logistics, fraud risks, cash handling, and record-keeping all become burdensome at scale.

The Power of Mobile Integration

Mobile devices can transform the COD experience from a manual, error-prone system into a streamlined, semi-automated workflow. Through SMS verification, QR code scanning, and mobile wallet confirmations, companies can:

Validate delivery in real-time

Track payments with digital receipts

Enable contactless transactions (especially critical post-COVID)

Minimize human error in change handling or payment disputes

The Role of Digital Tools in Micropayment Optimization

When a ₩1,500 payment costs ₩300 to process manually, the economics break down. However, introducing mobile-linked tools such as QR-based confirmations, low-fee mobile wallets, and integrated delivery apps can reduce per-transaction handling costs by over 40%. Services offering 소액결제 현금화 solutions increasingly reflect this efficiency trend, enabling smoother cash flow cycles for vendors.

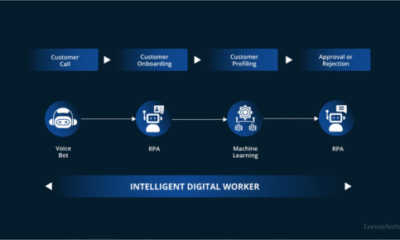

Key Components of a Mobile-Linked COD System

| Component | Function | Value |

| Mobile App | Captures delivery & payment | Reduces paperwork |

| QR Code Payment | Fast customer confirmation | Low friction |

| SMS Notification | Real-time communication | Low cost |

| e-Receipts | Digital proof | Increases trust |

| Micro POS Device | Lightweight payment hardware | Mobile-friendly |

How to Implement an Integrated System – Step-by-Step Guide

Evaluate Current COD Workflow: Track delays, errors, and cost points.

Choose a Mobile Payment Provider: Pick one offering API integration and support for small transactions.

Train Delivery Staff: Ensure the field team is familiar with mobile tools.

Pilot the Program: Start small in limited zones to monitor KPIs.

Gather Feedback and Optimize: Listen to customers and staff to fine-tune the UX.

Scale Nationwide: Once ROI is clear, expand system-wide.

Pros and Cons of Mobile-COD Hybrid Systems

| Advantages | Challenges |

| Lower cash handling costs | Requires tech-savvy delivery staff |

| Faster reconciliation | May face connectivity issues |

| Better fraud control | Upfront investment in tools |

| Enhanced customer satisfaction | Resistance from traditional customers |

Frequently Asked Questions (FAQ)

Q1: Is COD still relevant in 2025?

Yes, especially in regions where bank access or mobile wallets are limited.

Q2: What’s the biggest benefit of mobile-linked COD?

Real-time transparency and lower handling overheads.

Q3: Is there a way to automate COD without smartphones?

Yes, via SMS-based confirmations or simple USSD menus.

Q4: Can mobile payments fully replace COD?

Not entirely, but they can coexist to provide a smoother experience.

Smart Strategies for Small Transaction Optimization

Leverage loyalty points as digital tender for COD

Allow partial prepayments via mobile apps to build user trust

Enable instant refunds or wallet credits to enhance loyalty

Use GPS check-ins for delivery staff to validate cash pickups

Solving the Real Pain Points

Problem: High failed delivery rates in COD

Fix: Pre-confirm via mobile SMS before dispatch

Problem: Fraudulent claims of non-payment

Fix: Real-time e-receipts with GPS stamps

Problem: Poor record-keeping

Fix: Auto-synced cloud records via delivery app

Pro Tips for Vendors Adopting COD-Mobile Hybrids

Keep it simple. Don’t over-engineer the solution for basic users.

Use cashback rewards or fee waivers to drive digital adoption.

Choose platforms that support multiple payment channels—cards, wallets, and 휴대폰 결제 for broader coverage.

Consider partnering with fulfillment providers that already support mobile-COD infrastructure.

Conclusion: Merging Offline Trust with Online Speed

COD is no longer just about cash. When coupled with smart mobile tools, it becomes a hybrid solution that blends the comfort of face-to-face transactions with the efficiency of fintech. As consumers demand both trust and convenience, merging these systems isn’t just smart—it’s inevitable.

If you’re running a marketplace, logistics service, or even a local delivery business, now is the time to consider how COD and mobile integration can reshape your efficiency, especially in the underappreciated world of micropayments.

You must be logged in to post a comment Login